-

CREDIT REPAIR SERVICES

Let us start improving your credit scoreWe are so confident in our advanced disputing tactics that we will allow you to pay for your deletions after you see our results, and we even give you a 100% money-back guarantee to back it up so that you can relax. -

BUSINESS CREDIT

The Business Loans & Credit Lines You NeedGood credit is the lifeline of your business. It enables you to obtain funding for things like expansion, capital expenditures, research and development, and staffing. It is the principal contributing factor to your business’s future growth, not to mention the cash necessary for survival. -

REVIEW, REPAIR AND RECLAIM YOUR FINANCIAL FREEDOM

CALL: 559 761 9421Before enrolling in our program, a credit analyst will provide you with a consultation of your three credit bureaus and scores. Your analyst will clearly explain our program, how it works, and the options available to get your credit back on track. We will look for negative items like outdated or incorrect personal information, collections, charge-offs, tax liens, judgments, and late payments that may hurt your score. We will also guide you on what types of positive credit accounts should be applied to increase your scores at the fastest rate possible.

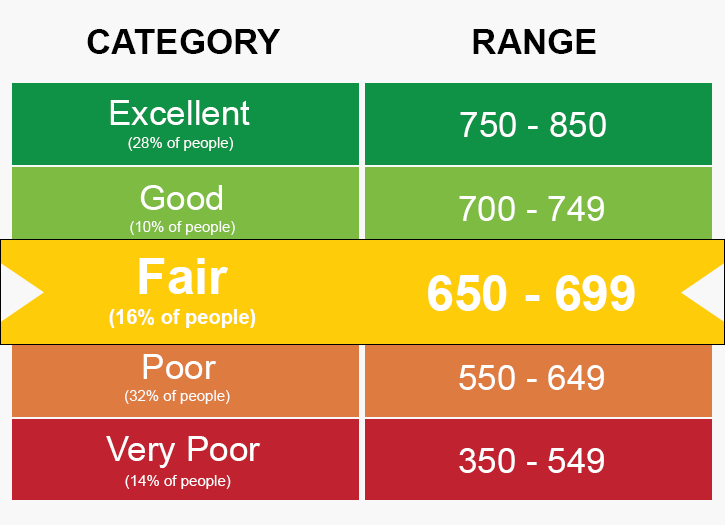

WE HAVE AN EXCELLENT TRACK RECORD IN HELPING CLIENT'S TO IMPROVE THEIR CREDIT SCORES:

PERSONAL CREDIT OPTIONS

Better credit score equals a better interest rate. An increase of only 20 points can means significant interest savings:

- Tens of thousands of dollars on your new home

- Hundreds of dollars on car payments

- Thousands on credit card interest

COLLECTIONS

Collection accounts stay on the credit report for seven years from the original delinquency date of the original debt, or the date of the first missed payment after which the account was no longer brought current. You may see both the collection account and the account with your original creditor on the credit report.

CREDIT REPAIR

How do I improve my credit score?” is the first question most of us ask when we’ve been turned down for a credit card or loan. And rightly so: An average to below-average credit score (720 or lower) can keep you from getting credit cards ...

MEDICAL BILLS

Unpaid medical bills can affect your credit scores. Typically, doctors and hospitals don't report debts to credit report agencies. Rather, they turn their unpaid bills over to a debt collector and it is the collection agency that reports them.

FORECLOSURES

According to FICO, if your credit score is 680, a foreclosure will drop your credit score on average by 85 to 105 points. If your credit score is excellent at 780, a foreclosure will drop your score by 140 to 160 points. ... Foreclosure, short sale or deed-in-lieu: 85 to 160.

STUDENT LOANS

This site is for informational purposes only to help individuals better understand programs/strategies that may be available.

CREDIT DISPUTES

The law allows people who are unfairly labeled as having bad credit to dispute any of the questionable items in their credit reports with the three credit bureaus, Equifax, Experian and TransUnion. Legally dispute negative items on credit reports.

TAX LIENS

Many people with tax liens on their credit reports mistakenly believe that the IRS or the state tax authority has directly reported the lien to the credit bureaus. That is a myth. Rather, the credit bureaus themselves proactively seek out tax liens and other public records

JUDGEMENTS

Although judgments can only remain on credit reports for seven years from the filing date, it doesn't mean they're simply going to go away at that time. In most jurisdictions a judgment creditor can have the judgment re-filed or “revived” before it expires, which varies state by state.

CHILD SUPPORT

Child support arrears remain on your credit report for up to seven years, unless you make a deal with the child support enforcement agency. An agency may agree not to report negative information to the credit reporting agencies if you pay some or all of the overdue support.

BANKRUPTCIES

Did you know that more than 500,000 Americans declare bankruptcy each year? While unfortunate, it’s helpful to know that you are not alone when it comes to dealing with a bankruptcy. Even after your bankruptcy is discharged, there is the aftermath to contend with as well; namely, repairing your credit

REPOSSESSIONS

It is possible to have a repo removed from your credit report before the 7 years. ... Another thing you can do is file a dispute with the credit bureaus. If the lender can't verify that the repossession is valid or fails to answer the dispute within 30 days, then it can be removed from your credit report.

RENTAL HISTORY TRADELINE

You can add 24 months of past rent payments to your credit report and build your credit history. The average time to see your results is 2 weeks.

We have had clients go from 300 to 699 in less than 30 days. Sign up today!!

PERSONAL CREDIT

Prior to enrolling in our program, a credit analyst will provide you with a consultation of your three credit bureaus and scores. Your analyst will clearly explain our program, how it works.

- We Analyze you credit reports

- We create an action plan

- We rebuild and repair your credit

BUSINESS CREDIT

Dun & Bradstreet has created a proprietary set of key ratings and scores that use information gathered from these sources to present an unbiased view of creditworthiness.

- PAYDEX Score

- Credit Limit Recommendation

- Financial Stress Score

5 REASON TO REPAIR YOUR CREDIT

-

MAKE RENTING EASIER

-

AVOID PAYING CASH FOR EVERTHING

-

STOP DEBT COLLECTOR HARASSMENT

-

OBTAIN HIGHER CREDIT LIMITS

-

PURCHASE A HOME WITH A LOW INTEREST RATE